As we age some things in life become far more enjoyable, while other hobbies and activities become harder to do with as much regularity as we might like. Aging is inevitable, but it doesn’t have to slow you down or prevent you from engaging in those things that make life enjoyable. Tackling the aging problem before it manifests is the best way to prepare for the effects that will eventually set in.

1.Understand your genetic predispositions

The people we are is the result of an unknown cocktail of nature and nurture, but some health complications stem completely from the genetic makeup that has created us. Myocarditis research suggests that heart disease is one complication that is typically inherited, therefore we can prepare for the threat of later heart muscle issues. Myocarditis is still not very well understood, but it typically affects younger adults and can result in congestive heart failure if not treated right away. Other genetically inherited health conditions include diabetes, high cholesterol, and even hemophilia. The Mayo Clinic recommends attacking vulnerabilities early on in life in order to prepare yourself for the possible or eventual onset of these conditions later on.

2. Start saving early.

Pensions, savings plans, and Social Security are all great resources to help aging Americans with their finances later in life, but the fact is that these can’t always cover the costs of a fulfilled lifestyle, and many elderly Americas must return to work to supplement their financial responsibilities. Begin to save early, on your own terms, and keep saving all the way through to retirement. This is the surest way to provide for yourself and your family as you age out of the primary working years of your life. Building a strong savings portfolio will enable you to live your life to the fullest once the constraints of work are lifted from your daily schedule.

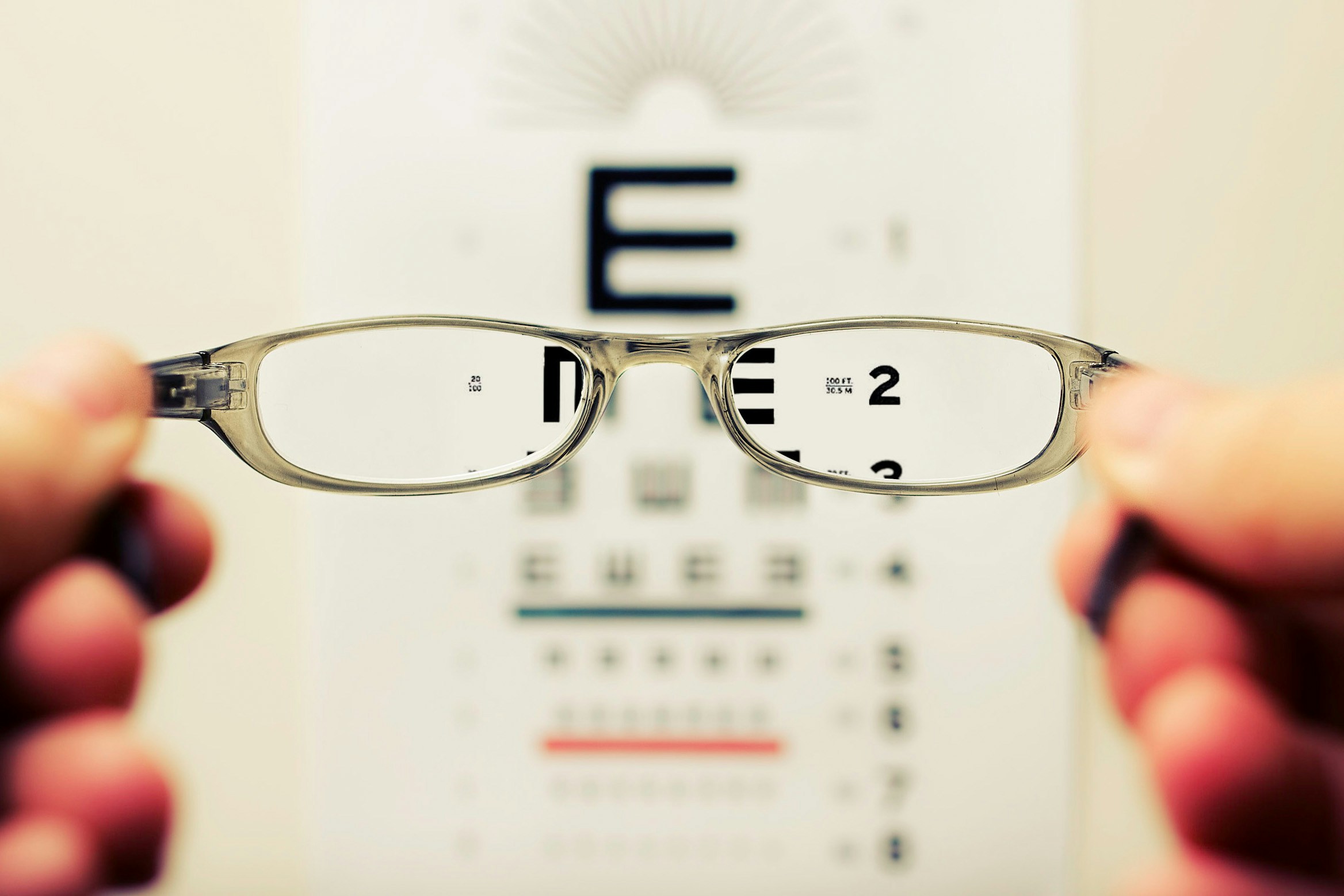

3. Get your hearing and vision checked.

Hearing is one of the many things that begin to fade as we age. Visiting a hearing aid center to check on your ear health and add a hearing aid to your daily routine is an important step for those losing the natural ability to hear. Vision and sound are two of the most important sensory stimulants in our lives, so if you start to experience hearing loss of blurry vision you must address it as soon as possible to ensure that your happiness and lifestyle don’t begin to suffer.

4. Organize your will.

Everyone should have a will, no matter the age. There is nothing worse in this life than working hard for decades only to have your life savings bitten into by the government when you die because you didn’t properly allocate your estate to your children or grandchildren. Planning your estate is an essential part of the savings arc. It shouldn’t be a taboo or bad omen, but rather a clear expression of your future wishes. Ideally, you would have explicitly directed estate transfer early in life when you first had children and reviewing your will is but a yearly formality at this point, but if you haven’t written one yet there is never a better time than the present.

5. Take up hobbies that excite you.

As you begin to move towards retirement, you should start thinking about what really makes you happy. Maybe you love playing golf, or perhaps scuba diving while on the lookout for reef sharks gets your heart pumping. Whatever you love to do in your free time, make it a habit to engage in those hobbies more and more as your work schedule begins to taper off. Everyone needs to take care of themselves on occasion, and retirement is exactly the time to lean into those things that make you happy.

Aging doesn’t have a negative part of life. On the contrary, some of your best years are ahead while you can enjoy both the freedom of financial stability and unimpeded time doing the things you love most. Plan for it and reap the rewards.